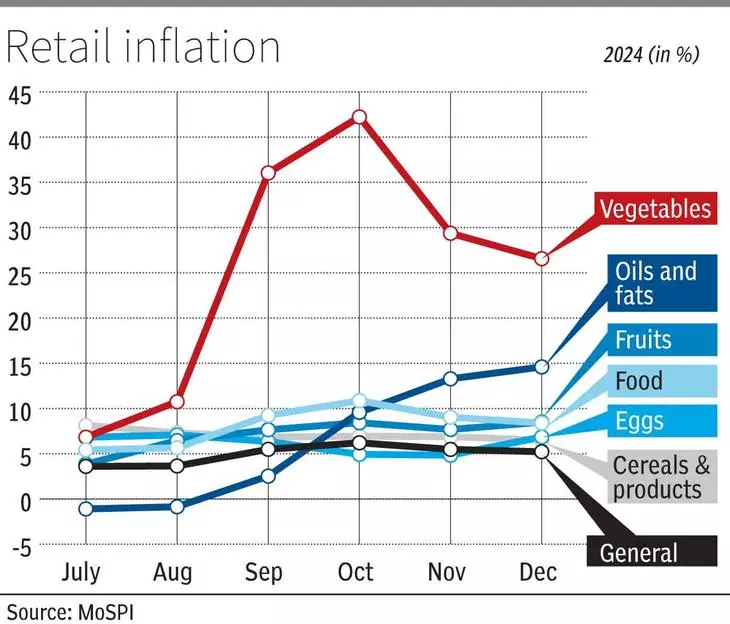

A significant decline in inflation was observed in vegetables, pulses and products, sugar and confectionery, personal care and effects, cereals and products

India’s retail inflation rate, measured by the consumer Price Index, for December stood at 5.2 per cent, showing a slight dip from 5.5 per cent in November on the back of of a notable drop in price of key food items including vegetables, pulses, sugar and cereals, government data showed on Monday. Despite the moderating print, economists remained divided over the policy rate cut.

Data showed that during December, a significant decline was observed in inflation in vegetables, pulses & products, sugar and confectionary, personal care & effects, and cereals and products, etc. The key items with lowest year-on-year inflation in December were jeera (-34.69 per cent), ginger (-22.93 per cent), dry chillies (-10.32 per cent), LPG – excl. conveyance (-9.29 per cent). The top five items showing highest year-on-year Inflation at all-India level in December were peas (89.12 per cent), potato (68.23 per cent), garlic (58.17 per cent), coconut oil (45.41 per cent) and cauliflower (39.42 per cent).

Rate cuts likely?

The December print is the fourth successive month of inflation higher than the median rate (4 per cent) of the targeted range (2-6 per cent). This has somewhat dampened hopes that the Monetary Policy Committee (MPC), scheduled to meet next month for the first time under Chairmanship of the new RBI Governor Sanjay Malhotra, would lower policy repo rate after May 22, 2020 and revision after February 8, 2023.

According to Paras Jasrai, Senior Analyst, India Ratings & Research (Ind-Ra), growth trajectory is picking up in 3QFY25 based on incoming high-frequency data which should give the MPC the policy bandwidth to move inflation closer to the 4 per cent mark. The ongoing rabi sowing has been progressing well which should help food inflation cool off further.

“The conviction of fiscal arithmetic would also be weighing closely on the monetary policy action. While the current data is positive from the monetary policy perspective, Ind-Ra believes that the monetary authority would want to wait for one more policy before undertaking any change on the rates front,” he said.

However, some economists still felt that rate could be lowered in February. “With the RBI MPC meeting in the first week of February, it will also consider the government’s budget proposals while taking into consideration the inflationary impact. However, with signs of moderation in food prices and the growth softening, the RBI is likely to opt for its first rate cut of 25 bps,” said Sujan Hajra, Chief Economist of Anand Rathi Group.

According to Upasna Bhardwaj, Chief Economist at Kotak Mahindra Bank, winter crop arrivals are further expected to keep food prices under check. “We expect the inflation trajectory to inch towards the RBIs medium term goal of 4 per cent over the next few months. Softening inflation and growth trajectory provides room for the onset of rate cutting cycle in the upcoming February policy. However, we remain cautious on account of global headwinds,” she said.

Source: www.thehindubusinessline.com